Jake’s Patent Winners was the best performing VectorVest Model Portfolio in Canada in 2014, up about 46%. I received an interesting question about it by email this morning from one of our Toronto (Guelph) area subscribers. Others may be wondering the same thing, so I decided to post my reply below. Here is what he was asking:

Jake’s Patent Winners was the best performing VectorVest Model Portfolio in Canada in 2014, up about 46%. I received an interesting question about it by email this morning from one of our Toronto (Guelph) area subscribers. Others may be wondering the same thing, so I decided to post my reply below. Here is what he was asking:

I am studying Jake’s Canadian portfolio. I see it is a long/short portfolio. I want to know more about how it works. I was wondering why is it holding 20% in cash and does not have a short position. I like the results. I just want to know the rules. Is there a manual for it that you can email me? Maybe they decided not to short. I see they sell when VST drops below 1.2 and use confirmed calls to buy. I just wonder what else am I missing. Thanks for your help.

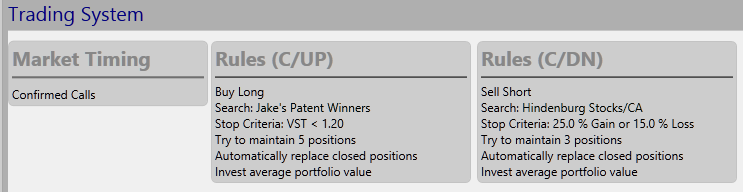

The trading rules for the portfolio are set out in the graphic above. You get this information when you Select An Existing Trading System when setting up a new portfolio. Simply choose, Jake’s Paten Winners. Well, Canada received a C/DN signal way back on September 19. So why haven’t any short positions been added? The reason is because there are still 4 long stocks in the portfolio after HCG was sold Sept 24. Now, notice the settings for the Rules C/DN. It states, “Try to maintain 3 positions.” Well, when we got the C/DN on Sept 19 and every day since, the Genius looks and sees there are still more than 3 stocks in the portfolio. Four is more than 3, so there is still no room to add a short position. Two more long positions would have to be sold in order to create room for one short position.

The trading rules for the portfolio are set out in the graphic above. You get this information when you Select An Existing Trading System when setting up a new portfolio. Simply choose, Jake’s Paten Winners. Well, Canada received a C/DN signal way back on September 19. So why haven’t any short positions been added? The reason is because there are still 4 long stocks in the portfolio after HCG was sold Sept 24. Now, notice the settings for the Rules C/DN. It states, “Try to maintain 3 positions.” Well, when we got the C/DN on Sept 19 and every day since, the Genius looks and sees there are still more than 3 stocks in the portfolio. Four is more than 3, so there is still no room to add a short position. Two more long positions would have to be sold in order to create room for one short position.

By then it might be too late, although not always if the downturn is a long one and your shorts drop quickly (no pun intended). I actually think this might be a limitation in the backtester and portfolio manager. It does not allow the ‘hedging’ you might expect to happen immediately after your chosen market down signal is given, in this case the C/DN.

If the trading plan’s intention is to hedge with short positions or contra ETFs, then I think the specified number of short positions should be added when the market signal is down, regardless of how many long positions remain in the portfolio. In the case for Jake’s for example, that would mean we could have up to 8 positions – the maximum of 5 longs and maximum of 3 shorts. To do this, the Genius would have to have a separate setting for the maximum number of positions total in the Portfolio, independent of the maximums for long and short positions. I’ve asked Development if this change might be possible. Perhaps someone would like to add it to the NEW FEATURE requests from the link on the Training tab?

How would this have affected Jake’s performance since the Sept 19 C/DN. Wouldn’t you know, in this case it would have cost the portfolio money. Why? Jake’s Patent Winners is up an amazing 18% since Sept 19 with the MG, ATD.B, GIL and CP remaining in the portfolio. Again, HCG was sold Sept 24, its VST score having fallen below 1.2. The VVC/CA is down about 3.44% during the same period in what can only be described as a wild ride.

What about those 3 shorts if they had been added Sept 22, the first trading day after the C/DN call? Well, two of the top 3 Hindenburg stocks from the Searches-Short folder on Sept 19 have moved higher. Not a good thing when you’re shorting. A Quicktest with no money management shows an average GAIN of 11.23%. Intertain Group (IT) gained 23.53% but would have stopped out with a 15% loss. Descartes Sys (DSG) is up 11.66% so it too would have cost the portfolio. Carfinco (CFN) is down (-1.50%), the only winner so far. So, shorting in this case would have cost the portfolio about five or six percent. The cost of insurance perhaps?

Your thoughts anyone?

– submitted by Stan Heller, Consultant

VectorVest Canada

January 10, 2015

A great analysis Stan! I think you need a little luck too. I still remain concerned about a steep downturn, as many of these stocks have a long ways to fall to reach their exit position, VST<1.2. Any ideas?

Warm Regards, Jake

Hi Jake. Your search and trading plan continues to be a favourite and benefit to many VectorVest investors. The model portfolio with the VST<1.2 Stop has done a pretty good job of letting winners run and protecting gains the last two years. I know what you mean though, the portfolio has some fantastic gains with GIL up 76% and CP up 59%. CP has given back about 20% from its high last October but you know, the VST is now at 1.21, so just above the STOP. Looking at the graph, it's hard to see what STOP would have been better, other than taking some of the profits off the table on the way up when the stock and the MTI is high, or perhaps switching to a tight trailing stop after the C/Dn. It's pretty hard to quibble with the results the automated plan has achieved!

I have been using this trading plan since the start of 2014 with great results. I modified it to not take short positions, no action on C/Dn calls. I’ve thought about changing the stops, but any backtest through any time frame I’ve tested to date tells me to not bother. For me this has truly been a lesson in keeping it simple, follow a plan & don’t over think. Thank you Jake for a great trading plan.

Great to hear Eric. Congrats, and thanks for sharing.

I too have been analyzing Jake’s Patent Winners portfolio and, in the process (to verify my analysis) I created a backtest that, when run with the same dates as Jakes portfolio, produced exactly the same results.

The blog won’t let me post a screen shot in here but I have 79.46% gain when I run it from 1/10/13 to 1/9/15 which matches exactly the portfolio results in the Genius.

The problem I have,however, is that when I run it from the 1st trading day in 2014 (1/2/14) up to 12/31/14 I get 18.73% gain. Of course, this means that the backtest would have started with an empty portfolio and selected the top stocks from the sort when run on 1/2/14 compared to starting the year with the holdings from the previous year that had not yet reached their stop criteria of VST < 1.2. While 18.73% is still a good result it is not in the same class as the approx. 45% you mention.

Is the 45% based on creating a portfolio with the holdings as of 1/2/14 and then manually posting the same trades the system made throughout 2014 or was it derived some other way.

Of course, I may also be doing something incorrectly in which case I would appreciate some guidance.

Hi Tom, Very useful analysis as always. In my article I took the results of the model portfolio from Dec 31, 2013 to Dec 31, 2014 and got the 46%. I didn’t think to run a new portfolio from the start of 2014. When I did just now, depositing cash on Jan 2 and making the first purchase on Jan 3, I get the 18% result you did. Interestingly, for the second test I deposited cash on Dec 31 and purchased the first stocks on Jan 2, one day earlier. That test returned 25%. So, I guess timing is everything. In a five stock portfolio, one or two exceptional performers can make quite a difference. The cool thing is, Jake’s seems to return consistently solid performers along with the occasional exceptional performer from time to time.

Was Jake’s Patent Winner Search shared. I do not see it as an option in the US system even though I think it was shared via your communications a good while ago. Where might I find it as I would like to test it on the US side.

Thanks,

Guy

I use Jake’s as well for finding some decent long-term holdings for my RRSP account, but I tend to buy DITM call options instead. I have found that with buying long calls 2-3 months out with Delta’s around 0.85-0.9 have performed very well. When the expiry day is 30 days out I have closed the positions and then re-entered into a new longer-term call. However I will only buy a call from this search if the MTI is above the MTI EMA(8).

An alternative to the Jake’s trading plan would be to use the Confirmed down to consider selling short-term calls either ATM or one-strike out. That way you get some option premium and in the “worst-case-scenario” your rising stock gets called away in a bad market you could always buy it back!

I have found that Petra’s EMA 3/8 cross-over technique works very well. In the Jake’s case I think you would have only been taken out of CP which is the only stock priced below where it was on Sept. 19th when the Confirmed down was issued.

Overall it is a great search for finding some long-term holds and time will tell how this search will perform in the period of increasing volatility that we seem to be moving towards!! Thanks for all your work on this Jake, it really has been a search that everyone in our Red Deer users group is familiar with and uses!!

Thanks for sharing your ideas and strategies here Michael. Very useful.

Sorry to have bothered you, Stan. I found Jake’s Patent Winners in Facebook

Thanks,

Guy

Glad you found it Gleason. We haven’t tested Jake’s for the US market, but with such solid criteria, it should perform very well there too.

I love the Jake’s search. I did mine in mid-August and my Jake’s portfolio is up 11.39% since then. I too was a bit confused when one of my Jake’s stocks was kicked out on Nov. 11 and the genius did not give me one to short. So I simply re-ran the Jake’s search and chose anther stock to go long with and get back to 5 positions (not exactly following the rules). It happened to be CCL.B and is only up 1.06% but that is certainly better than if I had tried shorting something and lost more.

I share the feeling Jake expresses above regarding how stocks can fall a long way before hitting the VST stop. Over the past few months I tried extending the VST < 1.2 stop idea to much of the rest of my portfolio and on some VST < 1.0 as used by some other portfolios. I learned the hard way that indeed they can drop a long way before hitting a VST stop as I watched my balance go down more and more but hung onto them because they still had good VST’s. I believe it was Todd Shaffer who also made a comment in a US webinar recently regarding how you have to be careful using VST stops. So my thinking now is that in my Jake’s Portfolio I will combine Petra’s weekly 3/8 with the VST< 1.2.

As an example, I am holding CP in my Jakes portfolio and have been watching it closely. A few days ago the VST slipped to 1.19 intraday but I decided to wait until the end of the day. It did end the day at 1.2 and tonight is 1.21 and CP is still in the portfolio. However I am right now up only $3.30. At best I was up $38.26 in late September. Had I used the weekly 3/8 I would have been out on the way down at $227.79 for a profit of $18.49 or 8.83% So long story short the VST stop will keep me in much longer but I would now rather get out sooner with more money. I will put more emphasis on the VST for buying but rely on it less for getting out.

Hi Tom. Very helpful comments and observations. Thank you. I had a similar revelation earlier this year because of AutoCanada. When they made a couple of poor business decisions and got in trouble with the CRA, institutional and retail investors started bailing and driving price lower long before the next financial reports showed the impact. I sold before my VST rule kicked in, but not nearly as early as I should have.

Stan,

Can you please send me Petra’s stock selection technique .

Thanks

Vinay

Hi Vinay, Thanks for your interest. I’ll send you some info and a video link after my webinar this morning.

You can find Petra’s Nov 21 BLOG article including a video link in the Technical Analysis category section. Her search for stocks is called Petra’s Flyers and is located in the Special Searches folder. Thanks again for your interest Vinay.

Hi Stan, Great blog. I too have implimented Jake’s strategy and would like a stop criteria that compliments Jake’s VST<1.2. I would appreciate it if you could please send me Petra's 3/8 stock selection (stop) technique also. Thank you, Ron

Thanks for your comments Ron. Petra’s weekly 3EMA/8EMA cross tends to be a bit faster than the VST<1.2, so something to consider. You can find her Nov 21 BLOG article including a video link in the Technical Analysis category section.