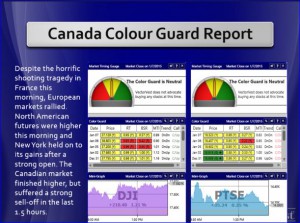

Despite the horrific shooting tragedy in France this morning, European markets continued to rally on the day. That seemed to lift North American futures and New York opened strongly. And while New York held on to its gains throughout the trading day, the Canadian TSX fell sharply in the last 1.5 hours and finished up just 35 points. It had risen 170 points at its peak this morning.

Despite the horrific shooting tragedy in France this morning, European markets continued to rally on the day. That seemed to lift North American futures and New York opened strongly. And while New York held on to its gains throughout the trading day, the Canadian TSX fell sharply in the last 1.5 hours and finished up just 35 points. It had risen 170 points at its peak this morning.

For a complete CA mid-week market video report, please click on the link below: http://www.screencast.com/t/hja44Z5zPn6

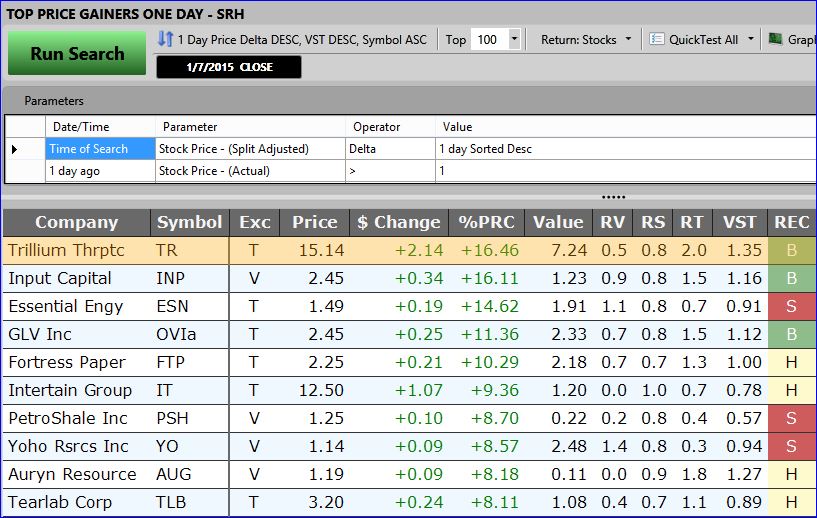

Below are the Top 10 CA Price Gainers for Jan 7, 2015:

Stan!

Great Blog and video! Hope you keep this up as I do not have the time to really peruse all the information that

vector vest affords!

One question I would like to ask you!

I have a portfolio which has a substantial amount of stocks { as many as 60} and want to pair down to at least ten!

Perhaps 2 from the following sectors: Energy , Mining including precious metals , Forestry and lumber products, Uranium and Financials!

What would your suggestion be to pare down from my existing and unfortunate situation?

Hope you can help me !

Ken

Hi Ken, Thanks for your kind comments about the Blog and video. I’ve certainly been encouraged to keep them going. Regarding your portfolio, most advisors agree that diversification is accomplished with between 16 and 32 positions. There is no further benefit beyond that, and a portfolio becomes difficult to manage in the way you may be experiencing now. I definitely think you’re on the right track. To pare down, VectorVest suggests “weeding your garden” by placing all your positions in a WatchList. Sort by Relative Timing (RT) and begin weeding out stocks with low RT. Study the graphs and if RT is still falling, those positions are the ones to go first. This process can be completed over time during market declines. Good luck Ken.