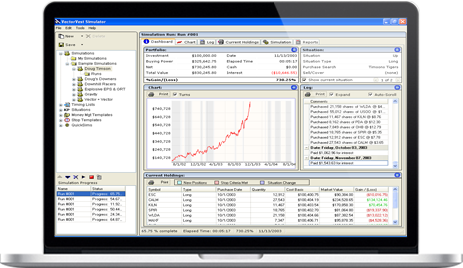

The VectorVest Simulator will allow you to buy, sell or go to cash using the market timing method of your choice. The Simulator also allows you to choose any combination of stock selection searches for purchasing decisions and specify when and why to close positions based on countless stop criteria. You can queue thousands of simulations to find just the right combination of market timing, stock selection strategies, stop criteria, and money management principles for your investment type. The possibilities are endless, but the Simulator will do all the work.

Available for a one-time fee of $2,995.

Buy the Simulator

Buy the Simulator- Timing Lists – A Timing List is a set of dates generated through a consistent method of market analysis. You can create and save as many timing lists as you’d like and the simulator will test them all.

- Situations – A Situation defines the new market condition on the associated timing date such as Up, Dn, or Neutral. A subsequent action will be taken based on each situation. ie. Buy Long, Sell Short, ect.

- Money Management Templates – These are portfolio management guidelines such as the number of stocks to trade, spending options, industry diversification, reinvestment options, ect.

- Stop Templates – Instruct the Simulator to sell or cover any stocks meeting predetermined conditions. For example, sell stocks when a trailing stop level is met or a moving average crossover occurs. You can use the preset stop criteria options or create your own. (ProTrader required for M.A. crossover)

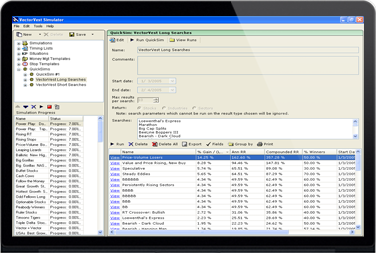

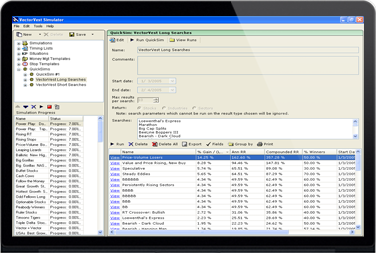

Want to know which of VectorVest’s 200+ preset strategies is best for you? With QuickSims you’ll get your answer in minutes. QuickSim will compare every strategy, over any time frame you select. To find the most consistent strategy of the bunch, run multiple QuickSims over different time frames. The Simulator will allow you to group the results of each run for each strategy to comprehensively analyze the data.

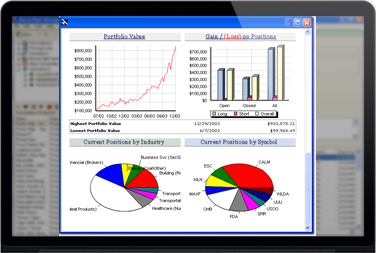

The Simulator includes three reports allowing detailed analysis of each run. The Summary report is a concise overview of the portfolio’s value, winners vs. losers, position allocation and fees. The Situational report tracks each simulation and its resulting gain/loss, maximum drawdown and average annual rate of return for each wave of the simulation. Finally, the Trade History report lists every trade in the portfolio, detailing each entry and exit point.

Les produits VectorVest

Les produits VectorVest Play Videos

Play Videos